Stablecoins for Settlement: Which Merchant Acquirers Are Leading the Charge?

- Kian Jackson

- Dec 13, 2025

- 5 min read

The payments landscape is experiencing a seismic shift as merchant acquirers embrace stablecoin settlement infrastructure. With the global stablecoin market reaching close to $250 billion as of May 2025, traditional payment rails are being reimagined through blockchain technology. But which acquirers are actually leading this transformation, and what does it mean for the future of commerce?

The Payment Giants Setting the Pace

Mastercard's Comprehensive Ecosystem Approach

Mastercard has positioned itself as the most comprehensive player in stablecoin settlement infrastructure. The payment giant offers an end-to-end proposition spanning wallet enablement, card issuing, and merchant acceptance: potentially reaching billions of terminals worldwide.

The company's August 2025 partnership expansion with Circle represents a watershed moment for global stablecoin adoption. This collaboration enables USDC and EURC settlement for acquirers across Eastern Europe, the Middle East, and Africa (EEMEA): marking the first time this region's acquiring ecosystem could settle transactions using stablecoins.

What sets Mastercard apart is its multi-stablecoin approach. Beyond Circle's offerings, the network supports Paxos' USDG, Fiserv's FIUSD, and PayPal's PYUSD, creating a diverse ecosystem that reduces single-point dependencies.

Visa's Always-On Settlement Revolution

Visa has been advancing stablecoin settlement since late 2023, when it launched 24/7 merchant payouts using stablecoins. This innovation bypasses traditional banking hour limitations: a significant competitive advantage in our always-connected economy.

The payment network's recent partnership with stablecoin orchestration platform Bridge demonstrates its commitment to mainstream adoption. Through API integration, fintech developers can now offer stablecoin-linked Visa cards across multiple countries, making digital currency accessible to everyday consumers.

Visa's roadmap includes supporting additional stablecoins, more blockchain networks, and expanded use cases within its settlement platform: signalling aggressive expansion plans.

Merchant Acquirers Actively Settling with Stablecoins

As of late 2025, several global and regional merchant acquirers are live or piloting stablecoin settlement:

Worldpay from FIS — Early participant in Visa’s USDC settlement pilots (Ethereum and Solana) and the first global acquirer to offer direct USDC settlement to merchants; also rolling out stablecoin payouts with partners to enable 24/7 disbursements.

Nuvei — Global acquirer in Visa’s stablecoin settlement programme, enabling USDC-based on-chain fund transfers and faster cross-border settlement to merchants.

Checkout.com — PSP/acquirer supporting 24/7 USDC settlement and weekend settlements via Fireblocks, allowing merchants to receive and manage on-chain balances alongside fiat.

Eazy Financial Services (Bahrain) — Regional first mover using the Mastercard–Circle rails to settle in USDC/EURC across EEMEA, offering merchants faster, lower-cost settlement.

Arab Financial Services (AFS) — Leveraging Mastercard’s stablecoin settlement framework to bring USDC/EURC settlement options to its acquiring clients in the Gulf and broader EEMEA.

Cross River — Acquirer and bank offering compliance-first stablecoin infrastructure, including network settlement and merchant payouts for regulated fintechs and enterprises.

Regional Pioneers Breaking New Ground

EEMEA's First Movers

In the Eastern Europe, Middle East, and Africa region, Eazy Financial Services has emerged as a trailblazer, becoming the first acquirer to pioneer USDC stablecoin settlement. According to founder and CEO Nayef Al Alawi, this innovation provides "future-ready infrastructure that directly solves the market need for greater liquidity and operational efficiency, significantly reducing friction associated with high-volume settlements."

Arab Financial Services has also joined this regional transformation, leveraging the Mastercard-Circle partnership to offer stablecoin settlement capabilities to their merchant base.

Cross River's Compliance-First Approach

Cross River has launched specialised stablecoin payments infrastructure targeting fintechs, enterprises, and crypto-native players. Their offering includes network settlement, merchant payouts, and on/off-ramp capabilities: all built with compliance as a core foundation.

This compliance-first approach addresses one of the key concerns traditional financial institutions have about stablecoin adoption, making Cross River an attractive partner for regulated entities.

Technology Infrastructure Developments

The technical infrastructure supporting stablecoin settlement is rapidly maturing. Modern acquirers are implementing multi-chain settlement capabilities, supporting everything from Ethereum-based stablecoins to faster, cheaper alternatives on networks like Solana and Polygon.

Real-time settlement represents perhaps the most compelling advantage. Unlike traditional card settlements that can take 2-3 business days, stablecoin transactions settle within minutes: dramatically improving cash flow for merchants and reducing counterparty risk for acquirers.

Smart contract automation is another key development. Acquirers can now programme automatic settlement rules, fee calculations, and compliance checks directly into blockchain transactions, reducing operational overhead while increasing transparency.

Regulatory Tailwinds Accelerating Adoption

The regulatory landscape has become increasingly favourable for stablecoin adoption. The landmark GENIUS Act, signed into law in July 2025, established the first federal regulatory framework specifically for payment stablecoins in the United States.

This regulatory clarity has driven increased confidence among payment providers. Platforms like PayPal and Stripe are already supporting stablecoin transactions, with industry observers expecting broader adoption throughout 2025 and beyond.

The European Union's Markets in Crypto-Assets (MiCA) regulation has similarly provided clarity for European acquirers, creating standardised compliance requirements that facilitate cross-border stablecoin payments.

Operational Advantages Driving Adoption

Cost Efficiency at Scale

Traditional cross-border settlements can cost between 3-7% of transaction value when accounting for foreign exchange spreads, intermediary bank fees, and processing delays. Stablecoin settlement reduces these costs to typically under 1%, representing massive savings for high-volume merchants.

24/7 Liquidity Management

Unlike traditional banking systems that operate within business hours, stablecoin infrastructure provides round-the-clock settlement capability. This is particularly valuable for digital-native businesses and international e-commerce platforms that operate across time zones.

Programmable Money Benefits

Stablecoins enable programmable settlement rules through smart contracts. Acquirers can automatically split payments between multiple parties, implement dynamic fee structures, or trigger compliance checks: all without manual intervention.

Challenges and Considerations

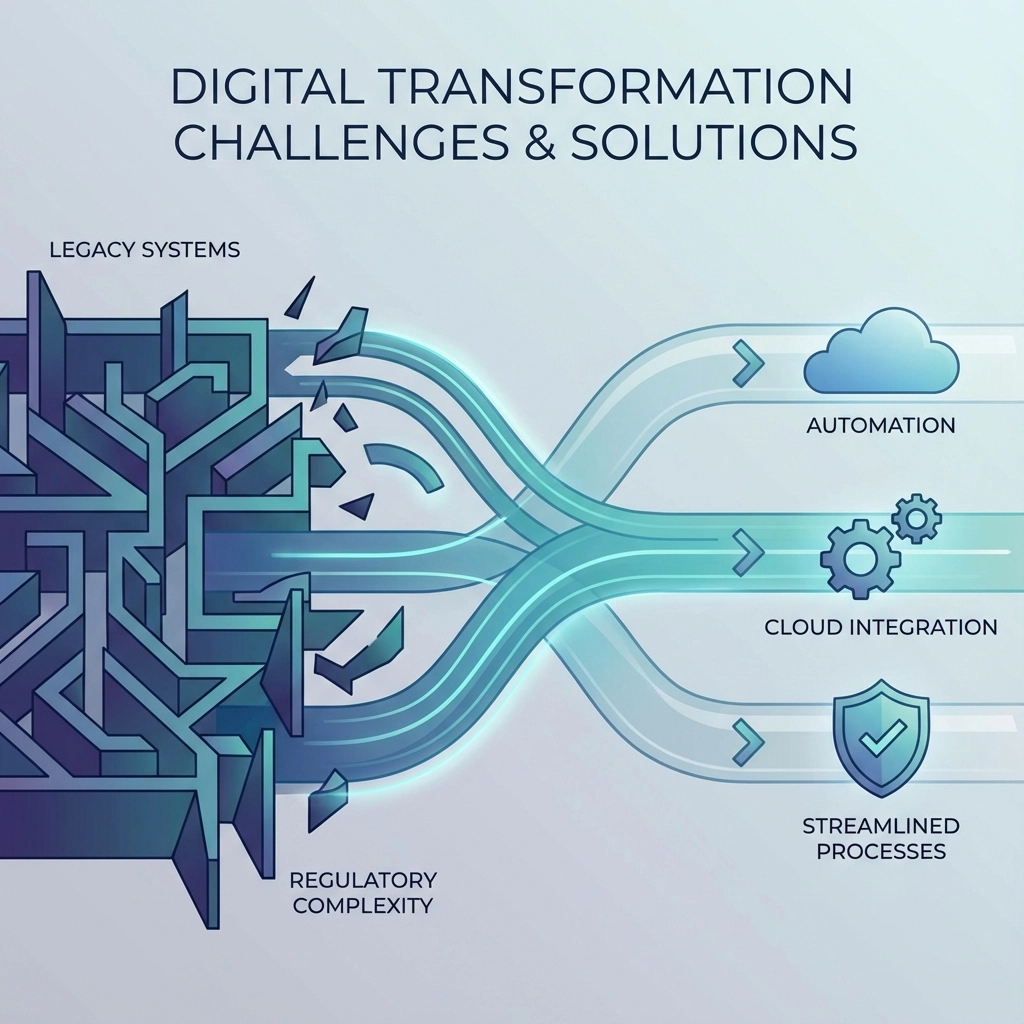

Despite the compelling advantages, stablecoin settlement adoption faces several challenges. Regulatory uncertainty in some jurisdictions continues to create hesitation among traditional acquirers. Additionally, the technical complexity of blockchain integration requires significant infrastructure investment.

Merchant education represents another hurdle. Many businesses remain unfamiliar with stablecoin benefits and may resist change from established payment rails. Successful acquirers are investing heavily in merchant education and support programmes.

What's Next for the Industry

The stablecoin settlement space is expected to see continued consolidation around major payment networks like Visa and Mastercard, while specialist providers like Cross River carve out niches in specific verticals or regions.

Central Bank Digital Currencies (CBDCs) may eventually compete with private stablecoins, though current timelines suggest stablecoins will maintain their first-mover advantage for the foreseeable future.

Integration with traditional banking infrastructure will likely deepen, with more acquirers offering hybrid settlement options that allow merchants to choose between traditional and stablecoin rails based on transaction characteristics.

The Competitive Landscape Evolution

The merchant acquiring landscape is becoming increasingly competitive as stablecoin capabilities become table stakes rather than differentiators. Acquirers must now compete on settlement speed, cost efficiency, and integration simplicity rather than just basic payment processing.

Regional specialists like Eazy Financial Services are proving that smaller players can compete effectively by focusing on local market needs and regulatory requirements. This creates opportunities for fintech startups and regional banks to challenge established players.

Strategic Implications for Financial Services

The shift towards stablecoin settlement represents more than just operational efficiency: it's fundamentally changing how financial services companies think about money movement. Traditional correspondent banking relationships may become less critical as blockchain-based settlement creates more direct pathways between institutions.

For merchant acquirers, the choice is increasingly binary: embrace stablecoin infrastructure or risk being displaced by more innovative competitors. The early movers are establishing significant competitive advantages that will be difficult for laggards to overcome.

Looking Ahead: 2026 and Beyond

As we move into 2026, expect to see mainstream adoption accelerate. The infrastructure is maturing, regulatory frameworks are solidifying, and merchant demand is growing. Acquirers that haven't begun their stablecoin journey risk being left behind in an increasingly competitive landscape.

The payments industry is experiencing its most significant transformation since the introduction of card payments decades ago. Stablecoins represent just the beginning of this blockchain-powered evolution, with smart contracts, programmable money, and decentralised finance set to further reshape how commerce operates.

Ready to navigate the stablecoin settlement revolution? At Kian Jackson, we help fintech companies and financial institutions develop winning strategies for emerging payment technologies. Whether you're evaluating stablecoin integration or planning your digital transformation roadmap, our expert consulting team can guide your journey. Contact us today to discuss how stablecoin settlement could transform your business operations.

Comments