What Fintech Leaders Need to Know About Google's New Agent Payments Protocol (AP2)

- Kian Jackson

- Sep 21, 2025

- 5 min read

Google just dropped something that could completely reshape how payments work in the AI era. Their new Agent Payments Protocol (AP2), announced in September 2025, isn't just another tech experiment: it's a serious play to solve one of fintech's biggest emerging challenges: how do we handle payments when AI agents start shopping for us?

If you're leading a fintech company, this isn't something you can afford to ignore. With over 60 major players already backing it: including PayPal, Mastercard, American Express, and Coinbase: AP2 is positioning itself as the industry standard for autonomous payments.

The Problem AP2 Solves

Think about how payments work today. You browse, you click "buy now," you enter your details, you authorise the transaction. Every step assumes you're physically present and actively involved. But what happens when your AI assistant needs to buy groceries, book flights, or purchase software licenses on your behalf?

Current payment systems simply weren't built for this reality. Without proper infrastructure, we're looking at a mess of fragmented integrations, inconsistent fraud detection, and unclear accountability when things go wrong. That's where AP2 comes in.

What Makes AP2 Different

AP2 isn't trying to replace your existing payment infrastructure: it's designed to work alongside it. The protocol is completely payment-agnostic, supporting everything from traditional credit cards to crypto transactions. This flexibility is crucial because it means fintechs don't need to rip and replace their current systems.

The protocol builds on existing standards like the Agent2Agent (A2A) protocol and Model Context Protocol (MCP), making integration more straightforward than building proprietary solutions from scratch. For crypto-focused fintechs, Google even collaborated with Coinbase to create A2A x402, providing production-ready infrastructure for agent-based cryptocurrency transactions.

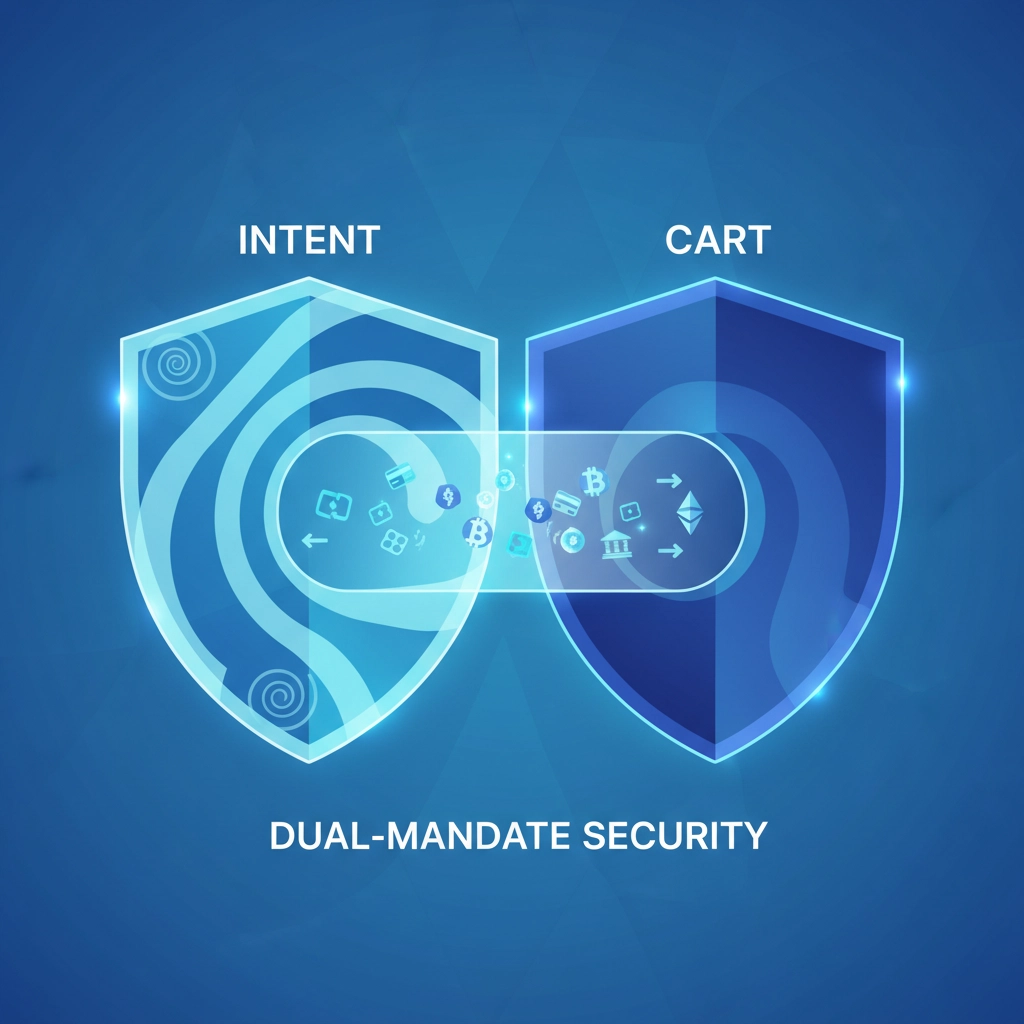

The Dual-Mandate Security Framework

Here's where AP2 gets clever. Instead of treating autonomous payments as an all-or-nothing proposition, it uses a dual-mandate system that balances convenience with security:

Intent Mandates: Users provide upfront authorisation for specific shopping intentions. For example, "I need a black blazer under $200 for a work event next week." This gives agents clear parameters to work within while maintaining user control.

Cart Mandates: Before any purchase is finalised, users get a final approval checkpoint. The agent might find three suitable blazers, but you still decide which one (if any) to buy.

For fully autonomous scenarios, AP2 allows agents to automatically generate cart mandates under pre-approved conditions, but requires more detailed upfront parameters including price limits and timing constraints.

Industry Backing That Actually Matters

When PayPal publicly backs a new payment protocol, you pay attention. Their endorsement wasn't just ceremonial: they specifically highlighted how their "global infrastructure, risk management systems, and two-sided network have been built over decades to provide the trust, compliance, and auditability that AP2 requires."

The full partner list reads like a who's who of global finance: Adyen, Revolut, Worldpay, Ant International, and dozens more. This isn't a Google side project: it's a collaborative effort to establish industry standards before the autonomous commerce boom hits full swing.

Opportunities for Fintech Companies

Early Mover Advantage: With AP2 still in its early stages, there's a window for innovative fintechs to become preferred implementation partners. Companies that master AP2 integration could find themselves in high demand as businesses scramble to enable agent-driven payments.

New Revenue Streams: Think beyond traditional payment processing. AP2 creates opportunities for specialised services like agent mandate management, autonomous fraud detection, and AI-driven merchant discovery platforms.

Enhanced Customer Experience: For consumer-focused fintechs, AP2 integration could dramatically improve user experience. Imagine AI assistants that can automatically pay bills, reorder supplies, or make investment transactions within predefined parameters.

B2B Market Expansion: Enterprise fintechs could leverage AP2 to offer autonomous procurement solutions, subscription management, or supply chain payments that require minimal human intervention.

Challenges to Consider

Regulatory Uncertainty: While AP2 includes strong accountability frameworks, regulatory bodies are still catching up to autonomous payment realities. Fintechs need to prepare for evolving compliance requirements.

Customer Trust: Convincing users to let AI agents spend their money requires exceptional security and transparency. The stakes are higher when human oversight is reduced.

Technical Complexity: Despite being built on existing standards, implementing AP2 effectively requires significant technical expertise and robust testing frameworks.

Fraud Prevention: Traditional fraud detection relies heavily on user behaviour patterns. Autonomous transactions create new attack vectors that security systems must learn to handle.

Implementation Roadmap for Fintech Leaders

Phase 1: Education and Planning (Next 3-6 months) Start by understanding AP2's technical specifications, which Google has made available on GitHub. Assess how the protocol aligns with your current technology stack and business model.

Phase 2: Partnership Evaluation (6-12 months) Identify potential integration partners within the AP2 ecosystem. Consider whether your company is better positioned as a payment processor, merchant services provider, or specialised autonomous payment platform.

Phase 3: Pilot Implementation (12-18 months) Begin with controlled pilot programs focusing on specific use cases. B2B applications might offer lower risk starting points compared to consumer-facing autonomous payments.

Phase 4: Scale and Optimise (18+ months) Expand successful pilot programs while continuously refining fraud detection, user experience, and compliance frameworks.

The Competitive Landscape Shift

AP2 isn't just a new protocol: it's potentially the foundation for an entirely new payment ecosystem. Companies that ignore it risk being left behind as autonomous commerce becomes mainstream. Those that embrace it early could find themselves at the centre of the next payments revolution.

The protocol's open-source nature means the barriers to entry are lower than proprietary alternatives, but the complexity of implementation still favours companies with strong technical capabilities and deep payments expertise.

What This Means for Australian Fintechs

For Australian fintech companies, AP2 represents both an opportunity and a challenge. The local market's strong regulatory framework and high digital adoption rates make it an ideal testing ground for autonomous payment solutions. However, companies will need to navigate AUSTRAC requirements and ensure AP2 implementations meet local compliance standards.

The timing is particularly relevant given Australia's ongoing open banking rollout and the Reserve Bank's focus on payments modernisation. AP2 could integrate well with existing open banking infrastructure, potentially accelerating adoption.

Getting Started

The autonomous payments revolution is already underway. While AP2 might seem like bleeding-edge technology, the underlying trends driving its development: AI adoption, automation demand, and user experience expectations: are accelerating rapidly.

Fintech leaders who start exploring AP2 now will be better positioned to capture opportunities as autonomous commerce moves from experimental to essential. The question isn't whether autonomous payments will become mainstream, but whether your company will be ready when they do.

Want to explore how AP2 could fit into your fintech strategy? Kian Jackson specialises in helping fintech companies navigate emerging payment technologies and regulatory challenges. Whether you're evaluating AP2 integration or planning broader digital transformation initiatives, getting expert guidance early can make the difference between leading the market and playing catch-up.

The autonomous payments era is coming faster than most people realise. The companies that prepare now will be the ones setting the standards tomorrow.

Comments